March 27, 2025 - 10:57

It’s great to get ahead of the game, but the work doesn’t stop there. As young individuals approach significant milestones, like turning 24 with $30,000 saved, it's crucial to develop a robust plan for managing those savings. Early financial management can lay the groundwork for long-term security and prosperity.

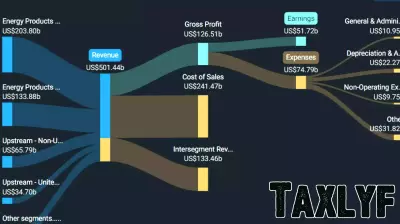

One effective strategy is to establish a budget that allows for both saving and spending. Allocating a portion of savings into an emergency fund can provide a safety net for unexpected expenses. Additionally, exploring investment options such as stocks or mutual funds can help grow savings over time.

Consider setting specific financial goals, whether it’s saving for a home, further education, or retirement. Utilizing tools like high-yield savings accounts or retirement accounts can also enhance savings potential.

By making informed decisions and staying disciplined, young savers can turn their initial savings into a foundation for a secure financial future.