April 17, 2025 - 15:21

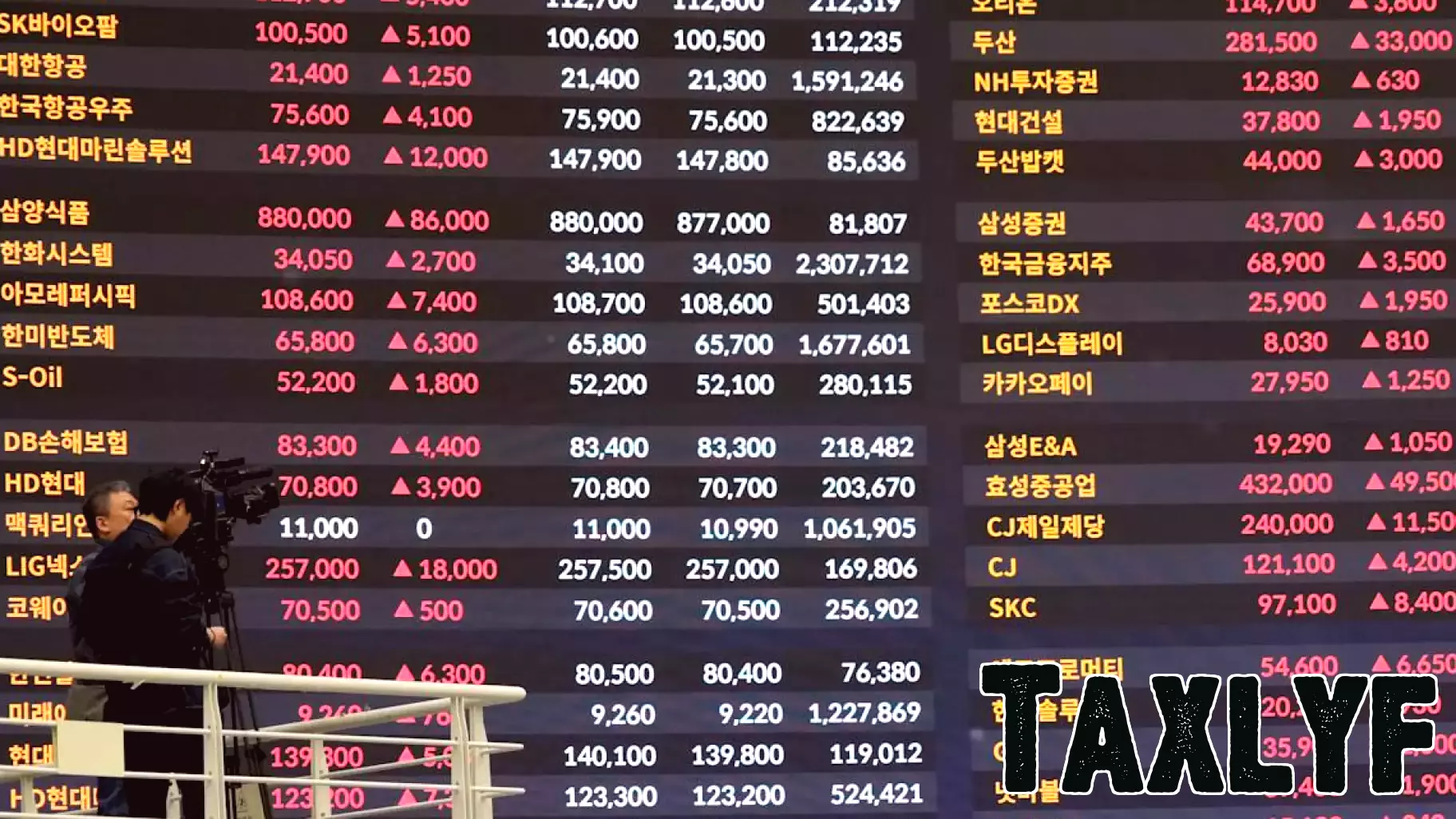

As the stock market navigates a complex landscape, earnings estimates are increasingly coming under scrutiny. Analysts are expressing concerns that current projections may be overly optimistic, particularly in light of ongoing tariff disputes and the potential implications of Federal Reserve policy shifts.

Investors are closely monitoring how these factors could impact corporate profitability in the coming quarters. The uncertainty surrounding tariffs has the potential to disrupt supply chains and increase costs for many businesses, which could ultimately affect their bottom lines. Furthermore, any changes in the Fed's approach to interest rates could have significant ramifications for market liquidity and investor sentiment.

Market participants are urged to remain vigilant as they assess the sustainability of earnings growth in this challenging environment. The convergence of tariff-related risks and Fed policy decisions could lead to a reevaluation of stock valuations, making it essential for investors to stay informed and adaptable in the face of these challenges.