March 22, 2025 - 19:38

Financial planners are recalibrating their personal financial strategies this year, often opting to prioritize short-term needs over long-term aspirations. This shift reflects a growing recognition of the need for flexibility in an ever-changing economic landscape.

One notable change is a focus on liquidity, with many planners emphasizing the importance of having readily accessible funds. This approach allows them to navigate unexpected expenses or market fluctuations without derailing their overall financial goals.

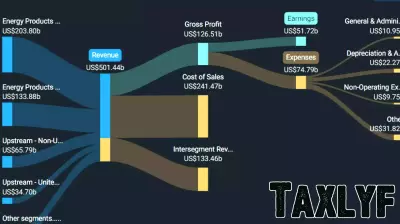

Additionally, planners are increasingly diversifying their investments. By exploring alternative asset classes, they aim to mitigate risks associated with traditional investments. This diversification not only enhances potential returns but also provides a buffer against market volatility.

Moreover, there is a renewed emphasis on mental well-being and financial health. Planners are advocating for a balanced approach that considers emotional factors, recognizing that financial stress can impact decision-making.

Ultimately, these adaptations highlight the dynamic nature of financial planning and the importance of remaining responsive to both personal and market conditions.