January 30, 2025 - 13:11

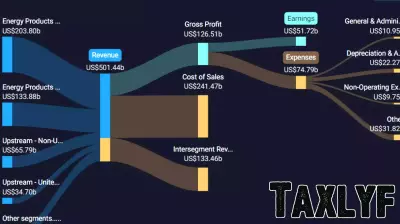

Michael Saylor’s MicroStrategy is emerging as a groundbreaking model for integrating cryptocurrency into traditional corporate finance. By boldly investing in Bitcoin, the company is not just making a financial bet; it is actively redefining the landscape of corporate treasury management. This innovative approach allows MicroStrategy to leverage the volatility and potential of digital assets while challenging conventional financial practices.

The company's strategy of converting cash reserves into Bitcoin reflects a broader trend among corporations seeking to enhance their balance sheets. By adopting cryptocurrency, MicroStrategy has positioned itself at the forefront of a financial revolution, attracting attention from investors and industry leaders alike. This bold move not only showcases the potential for significant returns but also highlights a growing acceptance of digital currencies as legitimate assets.

As more companies consider following MicroStrategy’s lead, the implications for traditional finance could be profound. The integration of cryptocurrencies into corporate strategies may pave the way for a new era of financial operations, where digital assets play a central role in driving growth and innovation.