April 13, 2025 - 03:21

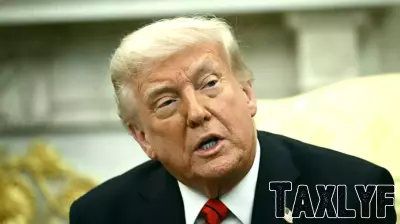

In February 2025, the Trump administration suspended operations at the Consumer Financial Protection Bureau (CFPB), a federal agency that safeguards consumers against fraud and unethical banking practices. With the future of this agency in limbo, many consumers are left wondering how to address grievances with their banks effectively.

First, it's crucial to document all interactions with your bank, including dates, times, and the names of representatives you speak with. This information can be invaluable if you need to escalate your complaint. Next, consider reaching out directly to your bank's customer service or complaint resolution department, as many institutions have internal processes for handling customer issues.

If the response is unsatisfactory, you can escalate your complaint to the bank's ombudsman or a higher-level manager. Additionally, filing a complaint with state banking regulators can provide further recourse. Engaging with consumer advocacy groups may also offer support and guidance on navigating the complaint process.

Lastly, utilizing social media platforms can amplify your concerns, as many banks monitor their online presence closely. As the landscape of consumer protection evolves, staying informed and proactive will be key to ensuring your rights are upheld.