March 27, 2025 - 23:19

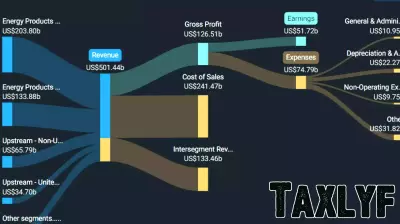

In a significant move to alleviate financial strain on citizens, Pakistan's Finance Minister has announced plans to lower the tax burden across various sectors. This initiative is part of a broader strategy to stimulate economic growth and enhance the purchasing power of individuals and businesses alike.

The Finance Minister emphasized the government's commitment to creating a more equitable tax system that encourages investment and promotes economic stability. By reducing taxes, the administration aims to foster a conducive environment for entrepreneurship and innovation, ultimately leading to job creation and increased productivity.

The proposed changes are expected to benefit a wide range of taxpayers, including small and medium-sized enterprises, which are crucial for the country's economic development. The government believes that by easing the tax load, it can stimulate consumer spending and drive economic recovery in the wake of recent challenges.

As the plan unfolds, stakeholders from various sectors are closely monitoring these developments, hopeful that the reforms will bring about positive change in the nation's economic landscape.