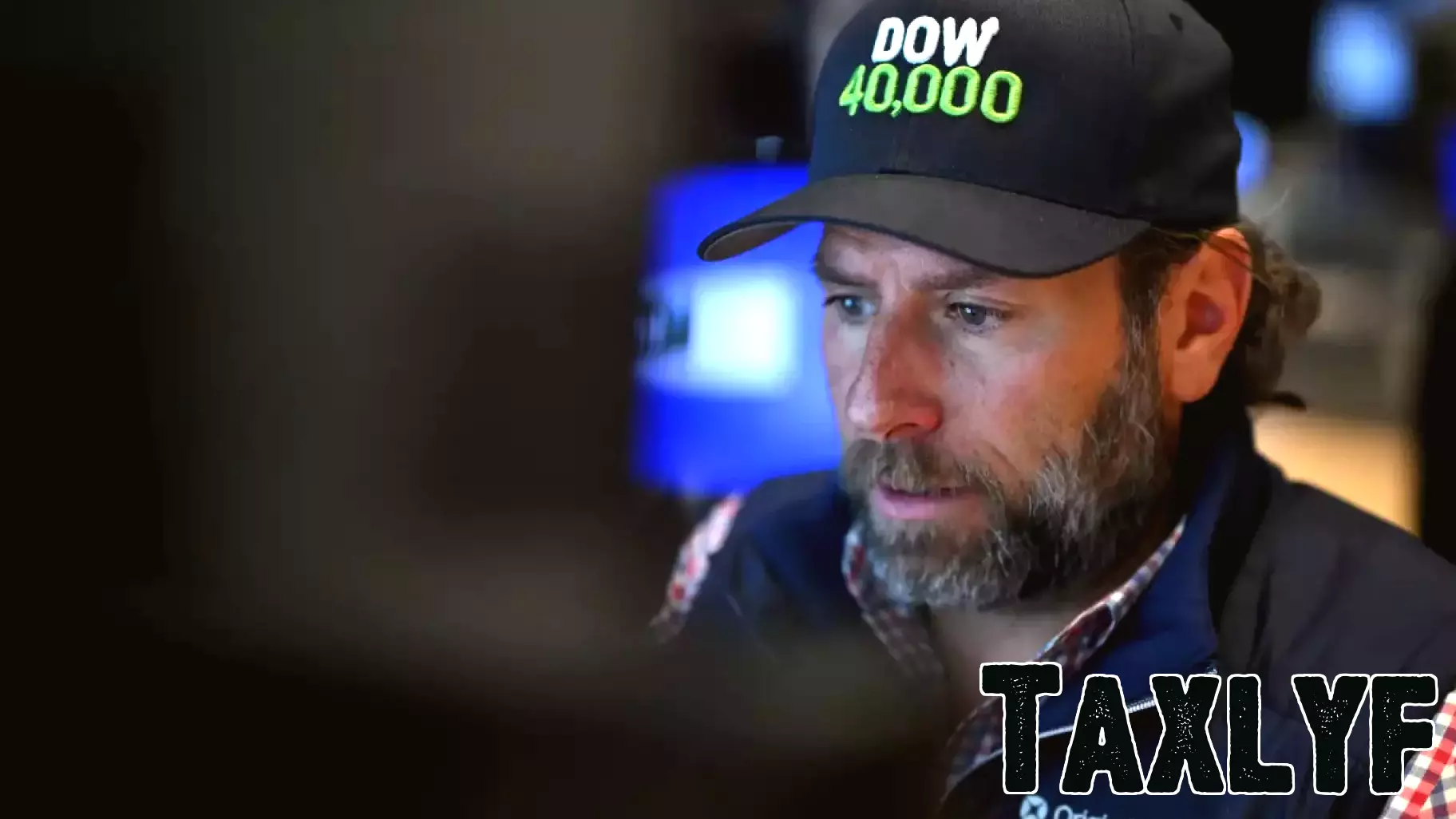

Stocks Poised for a Strong Finish to a Booming Year

December 31, 2024 - 12:46

Stocks are gearing up for a robust conclusion to a remarkable trading year, bouncing back after a sluggish start. Investors are optimistic as futures for major indices, including the Dow Jones Industrial Average, S&P 500, and Nasdaq, indicate a potential rebound. This surge comes on the heels of a year marked by significant market fluctuations, with many sectors experiencing notable gains.

Despite a rocky period leading up to the year-end, market analysts believe that positive momentum is building. Economic indicators suggest a resilient economy, which could bolster investor confidence. The tech sector, in particular, is showing signs of strength, contributing to the overall positive sentiment in the market.

As traders prepare for the final trading days of the year, attention is focused on key economic data releases and corporate earnings reports that could influence market direction. Investors are hopeful that this rebound will set the stage for a prosperous start to the new year.

MORE NEWS

February 28, 2026 - 02:28

Why Axos Financial (AX) Shares Are Sliding TodayShares of Axos Financial experienced a sharp decline in Thursday`s trading session, mirroring a broader downturn across the financial sector. The digital bank`s stock fell nearly 9% following the...

February 27, 2026 - 23:14

House Finance Committee advances millionaires tax bill to full voteA landmark proposal to institute the first-ever income tax in Washington state has cleared a critical hurdle. The House Finance Committee voted to advance the bill, setting the stage for a full...

February 27, 2026 - 05:38

Super Group (SGHC) Limited (SGHC) Reports Financial Results For Fourth Quarter and Full Year 2025Super Group (SGHC) Limited, the parent company of leading global online sports betting and gaming brands, has released its financial results for the fourth quarter and full year ended December 31,...

February 26, 2026 - 20:17

Rocket Pharmaceuticals Reports Fourth Quarter and Full Year 2025 Financial Results and Highlights Recent ProgressCRANBURY, N.J., February 26, 2026—Rocket Pharmaceuticals, a late-stage biotechnology firm, has released its financial and operational results for the fourth quarter and full year ending December...