March 22, 2025 - 05:25

As the great wealth transfer continues, with an estimated $124 trillion expected to shift across generations by 2048, individuals are seeking effective strategies to build wealth in today's volatile market. In a recent discussion, financial experts emphasized the importance of adapting investment strategies to navigate uncertainty.

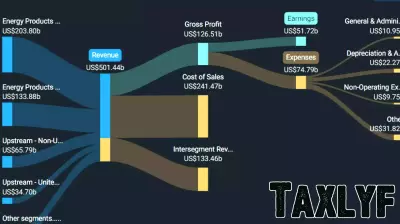

One key tip is to diversify investments. Spreading assets across various sectors and asset classes can help mitigate risks associated with market fluctuations. By not putting all your eggs in one basket, investors can protect themselves from significant losses during downturns.

Another crucial strategy is to maintain a long-term perspective. While market volatility may tempt investors to make impulsive decisions, staying focused on long-term goals can yield better results. This involves regularly reviewing and adjusting portfolios to align with changing market conditions while resisting the urge to react hastily to short-term market movements.

By employing these strategies, individuals can enhance their chances of building wealth even in challenging economic environments.