These Were the Year's Weakest Links in the Broad Market Index

January 1, 2025 - 21:47

As the year progresses, investors closely monitor stock performance within the S&P 500, the benchmark for U.S. equities. In 2024, several companies have emerged as notable underperformers, raising concerns among stakeholders.

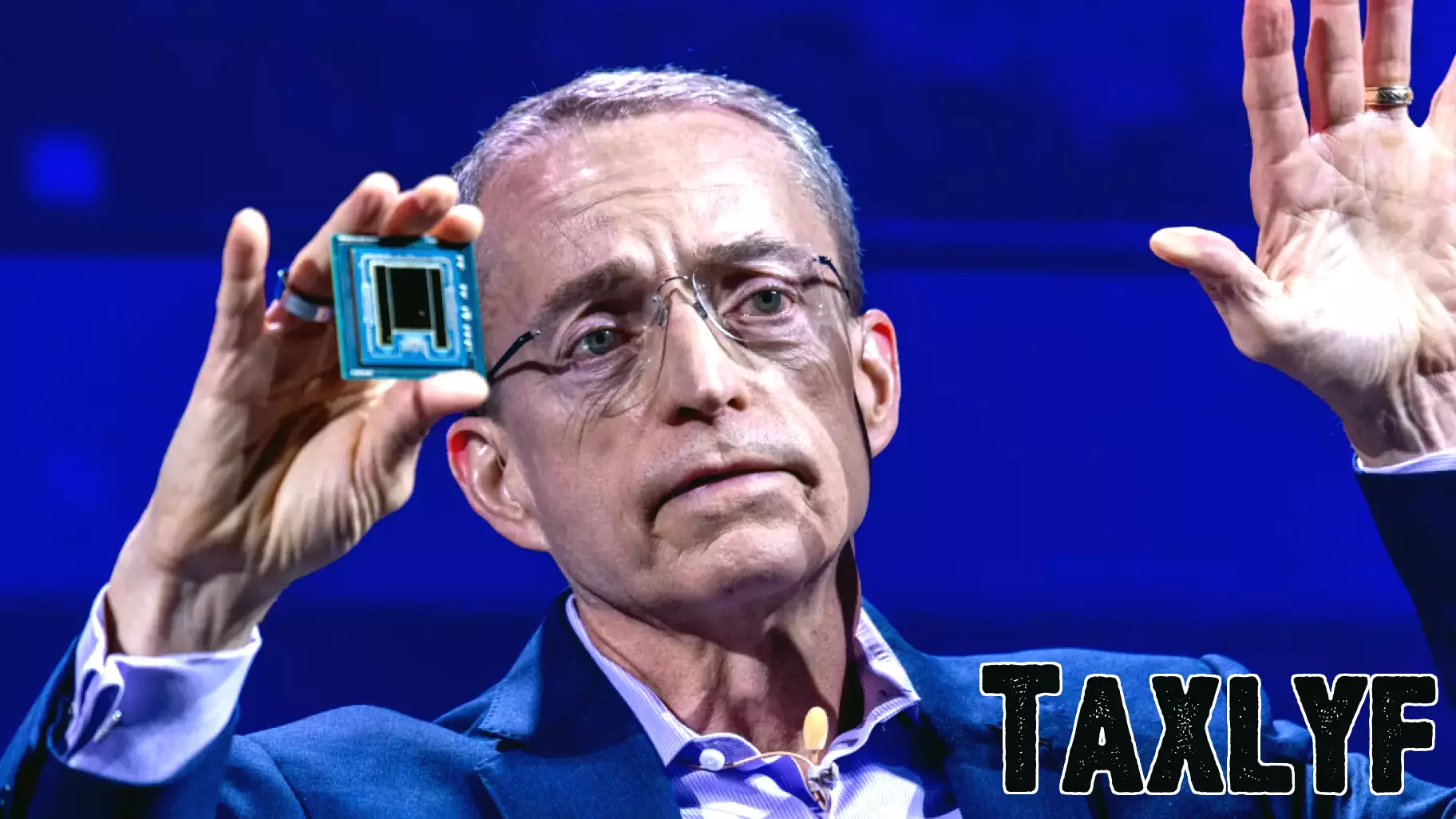

Leading the list of the weakest stocks are those that have faced significant challenges, including fluctuating market conditions and adverse economic indicators. Industries such as technology and consumer discretionary have seen some of the steepest declines, with companies struggling to maintain growth amidst rising interest rates and inflationary pressures.

One of the most pronounced examples is a tech giant that has grappled with supply chain disruptions, resulting in a substantial drop in its stock price. Similarly, a major retailer has faced declining sales, prompting analysts to revise their forecasts downward.

Investors are advised to exercise caution as these underperformers may continue to face headwinds in the coming months. The performance of these stocks serves as a reminder of the volatility inherent in the market and the importance of thorough research before making investment decisions.

MORE NEWS

March 9, 2026 - 23:40

Retail earnings: What to expect from Kohl's, Dollar General, Dick'sThis week brings a crucial snapshot of consumer health as major retailers Kohl`s, Dollar General, and Dick`s Sporting Goods prepare to release their quarterly earnings. The reports are expected to...

March 9, 2026 - 09:02

A Look At Federated Hermes (FHI) Valuation After Weak February Jobs Report Weighs On Financial StocksA surprisingly weak U.S. jobs report for February, which indicated declining employment and a rising unemployment rate, triggered a broad sell-off in the financial sector. Among the affected...

March 8, 2026 - 18:49

A surprising outcome of the railway bubbleThe speculative frenzy of the 19th-century railway bubble offers a stark and surprising historical parallel for modern markets, particularly for those navigating the current surge in artificial...

March 8, 2026 - 03:28

German finance minister warns against economic panic over Iran warGerman Finance Minister and Vice Chancellor Lars Klingbeil issued a call for economic composure on Saturday, cautioning against alarmist rhetoric regarding the potential fallout from the...