January 24, 2025 - 13:28

Recent reports indicate a record surge in the number of companies experiencing critical financial distress, raising alarms among insolvency specialists and economic analysts alike. This alarming trend reflects the ongoing challenges businesses face in an increasingly volatile economic landscape, characterized by rising inflation, supply chain disruptions, and changing consumer behavior.

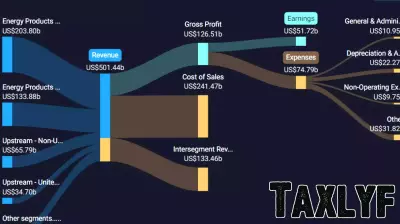

The data reveals that many sectors are grappling with severe cash flow issues, leading to a heightened risk of insolvency. Experts suggest that the combination of escalating operational costs and stagnant revenue growth has created a perfect storm for many companies. Small and medium-sized enterprises, in particular, are feeling the pinch, with many struggling to secure necessary funding to navigate these turbulent times.

In response to this crisis, industry leaders are calling for increased support from financial institutions and government initiatives to help stabilize the business environment. Without timely intervention, the consequences could be dire, potentially leading to significant job losses and a further contraction of the economy. The situation underscores the urgent need for strategic planning and financial resilience among businesses moving forward.